Bank of England Governor: Interest Rate Hikes Near Peak

The head of the Bank of England has informed Members of Parliament that interest rates might not go up by a lot more because they expect inflation to drop significantly by the end of the year.

The Bank’s leader informed Members of Parliament that interest rates are now much closer to reaching their highest point after the 14th consecutive increase, which brought them to 5.25% last month. He also expressed optimism that inflation will see a significant drop by the end of 2023.

His remarks will bring some encouragement to homeowners and the broader housing market, which has faced a downturn in recent months due to elevated mortgage rates.

Speaking before the Commons Treasury Committee on Wednesday, the governor also reaffirmed his expectation that inflation is likely to see a significant decrease this winter.

However, he also warned that inflation could temporarily “rise” due to the uptick in petrol prices in August and concerns about the increasing cost of oil.

Mr. Bailey informed MPs that while there was a time when it was evident that interest rates needed to go up, the Bank is no longer in that situation.

He added: “the judgements now are much finer… I think we are much nearer now to the top of the cycle.

“And I’m not therefore saying we’re at the top of the cycle, because we’ve got a meeting to come, but I think we are much nearer to it, on interest rates, on the basis of current evidence.”

The majority of economists anticipate that the Bank will raise interest rates for the 15th consecutive time to 5.5% later this month. They also predict that rates will reach their highest point at 5.75%, according to a poll.

Even though inflation has been slowly decreasing from its highest point of 11.1% in October of last year, the rate of price increases, which was at 6.8% for the year ending in July, is still quite high.

When asked about inflation, the governor told MPs: “Many of the indicators are now moving as we would expect them to move, and are signalling that the fall in inflation will continue and, as I’ve said a number of times, I think [it] will be quite marked by the end of this year.

“I should say possibly that we will get a tick up in the next release because fuel prices went down in August last year and went up a bit in August this year… but I don’t [see] that as a central change in the path.”

The British pound fell to a nearly three-month low against the US dollar, reaching around $1.24, in response to his statements about decreasing inflation. These remarks were in line with comments made by Chancellor Jeremy Hunt over the weekend. Mr. Hunt cautioned that inflation might experience a temporary increase but also expressed confidence that it would be cut in half as promised by the end of 2023.

Mr. Haldane mentioned that the Bank had engaged in quantitative easing, essentially printing money, to support the economy in response to COVID for a longer duration than necessary. He also indicated that the Bank might have been too slow in raising interest rates.

The governor emphasized that his former colleague had made these comments “in hindsight.” and said: “I don’t enter into those judgements because I think it is very difficult to separate out the hindsight judgement from the decision at the time”.

But, commenting on the “last phase” of quantitative easing to support the economy following COVID, he said: “I think most of the people who give evidence on this say they don’t think actually it made a major contribution to inflation”.

Never miss any important news. Subscribe to our newsletter.

Related News

British Investor Who Predicted US Slump Warns of Next Crash

I’m a Death Doula: 4 Reasons I Believe Death Isn’t the End

Tech to Reverse Climate Change & Revive Extinct Species

AI Unlocks the Brain’s Intelligence Pathways

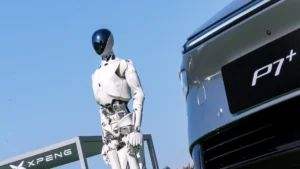

XPENG Unveils Iron Robot with 60 Human-like Joints

Can AI Outsmart Humanity?

11 ChatGPT Prompts to Boost Your Personal Brand

Keir Starmer Hints at Possible Tax Hikes on Asset Income

Navigating the Future of AI: Insights from Eric Schmidt